Introduction

- The economic wealth or well-being of a country does not only depend upon the possession of resources, it also depends upon the optimum utilization of resources is more important.

- The consumer may refer to an individual or enterprise that purchases goods and services for their personal use or for industrial or household use.

- When goods are used for further production, they lose their original characteristics and get transformed into other commodities.

- An item that is meant for the final use and will not pass through any more stage of production or transformation is called a final good or an end product.

- Cooking at home is not an economic activity because home cooked food is not to be sold in the market, but when the same food is cooked in a restaurant for the customers, it becomes an economic activity.

Types of Goods

- Goods and services, which are purchased and consumed by their ultimate consumer are called consumption goods or consumer goods. For example, cloth, shoe, pen etc.

- Goods, which are durable in nature and used in the production process like tools, machinery and implements are also called final goods because they can’t change themselves at the time of production.

- Commodities like television sets, automobiles or home computers are also durable goods, which are used by their ultimate consumer. These commodities are also called consumer durables.

- Goods, which are used as raw material or input for the production of other commodities are called intermediate goods. These are not final goods. For example, plastics used for making chair, iron & steel used for making vehicles, etc.

Calculating National Income

- Money is the common measuring means for the calculation of total final goods and services produced in the economy.

- The calculation of the value of final goods and services does not consider the value of intermediate goods.

- Depreciation refers to a fall in the value of fixed assets due to normal wear and tear.

- Net investment = Gross investment – Depreciation.

- Total final output produced in an economy includes output of consumer goods and services and output of capital goods.

- More sophisticated and heavy capital goods raise the ability of a labourer to produce goods. For example, the traditional weaver would take months to weave a sari, but with modern machinery, thousands of pieces of clothing are produced in a day.

- There are mainly four kinds if contributions that can be made during the production of goods and services −

- Contribution made by human labour (remuneration which is also called wage);

- Contribution made by capital (remuneration which is called interest);

- Contribution made by entrepreneurship (i.e. profit); and

- Contribution made by fixed natural resources/land (remuneration which is called rent).

- In a simple economy, the aggregate consumption by the household of an economy is equal to the aggregate expenditure on goods and services produced by the firm in the economy.

- There is no leakage from the economic system because in a simple economy, we assume that there is no government; where there is no government, there is no tax payment, there are no exports and imports and that the domestic economy is a closed economy.

- Value added, is the term, which is used to denote the net contribution made by a firm during the production process.

- The replacement investment is always the same as the depreciation of the capital.

- If we include depreciation in the Value Added, we obtain Gross Value Added and when we deduct the value of depreciation from Gross Value Added, we obtain the Net Value Added.

- The stock of finished goods, or semi-finished goods, or raw materials, which a firm carries from one year to the next year is called inventory.

- Change of inventories of a firm during a year = production of the firm during the year – sale of the firm during the year.

- Production of the firm = value added + intermediate goods used by the firm.

- Change of inventories of a firm during a year = value added + intermediate goods used by the firm during a year.

- The change in inventories taking place over a period of time is called flow variables.

- Addition to the stock of capital (like inventories) of a firm is known as investment.

- There are mainly three categories of investment −

- The rise in the value of inventories of a firm over a year, which is treated as investment expenditure undertaken by the firm;

- The fixed business investment, which is defined as the addition to the machinery, factory buildings, and equipment employed by the firms; and

- The residential investment, which refers to the addition of housing facilities.

- If there is unexpected fall in sales, there will be an unplanned accumulation of inventories, but if there is unexpected rise in the sales, there will be an unplanned shortage of inventories.

- Gross value added (GVA) = Value of sales by the firm + Value of change in inventories – Value of intermediate goods used by the firm.

- Net value added of the firm = Gross Value Added – Depreciation of the firm.

- Net value added of the firm = Gross Value Added – Depreciation of the firm.

- Gross Domestic Product of the economy is the sum total of the net value added and depreciation of all the firms of the economy. Summation of the net value added of all firms is called Net Domestic Product (NDP).

- The final expenditure is calculated on the following accounts −

- The final consumption expenditure on the goods and services produced by the firm.

- The final investment expenditure incurred by other firms on the capital goods produced by a firm.

- The expenditure that the government makes on the final goods and services produced by a firm.

- The export revenues that a firm earns by selling its goods and services abroad.

- According to the expenditure method, GDP = Sum total of all the final expenditure received by the firms in the economy.

- When government expenditure exceeds the tax revenue earned by the government, it is called the budget deficit.

- When import expenditure is more than the revenue earned from export, it is called the trade deficit.

- Gross National Product = GDP + Factor income earned by the domestic factors of production employed in the rest of the world – Factor income earned by the factors of production of the rest of the world employed in the domestic economy.

- If we deduct depreciation from GNP, the measure of aggregate income that we obtain is called Net National Product (NNP). Thus, NNP = GNP – Depreciation.

- Income which is earned by a household is called Personal Income.

- Personal Income (PI) = National Income – Undistributed profits – Net interest payments made by households – Corporate tax + Transfer payments to the households from the government and firms.

- Personal Disposable Income (PDI) = Personal Income – Personal tax payments – Non-tax payments.

- National Disposable Income = Net National Product at market prices + Other current transfers from the rest of the world.

- Private Income = Factor income from net domestic product accruing to the private sector + National debt interest + Net factor income from abroad + Current transfers from government + Other net transfers from the rest of the world.

- Real GDP is calculated at constant price (base year price) of goods and services; on the other hand, Nominal GDP is calculated at the current price of goods and services.

- In the calculation of real and nominal GDP of the current year, the volume of production is fixed.

- The ratio of nominal to real GDP is known as index of prices it is also known as GDP Deflator.

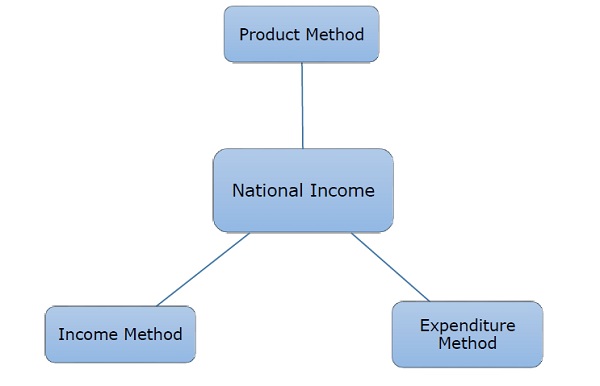

Methods for Measuring National Income

There are different methods of estimating National Income. The methods are as follows −

- In product method, national income is measured on the basis of the flow of goods and services. We calculate money value of all final goods and services produced in an economy during a year.

- In expenditure method, national income is measured as a flow of expenditure. Government consumption expenditure, gross capital formation (Government and private) and net exports (Export-Import).

- In income method, national income is measured as a flow of income factor. There are generally four factors of production −

- Labor (gets wages/salary)

- Capital (receives interests)

- Land (receives rent)

- Entrepreneurship (gets profit as remuneration)

No comments:

Post a Comment